proposed estate tax changes october 2021

According to a recent study the proposed change would permeate numerous sectors of the economy. For married taxpayers filing jointly the additional tax would be triggered above 5 million of modified adjusted gross income.

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Instead it contains three primary changes affecting estate and gift taxes.

/dotdash-7-of-the-highest-stock-prices-in-history-brk-b-aapl-seb-nvr1114-FINAL-74561db190a74d4aa1197891d2328783.jpg)

. As difficult as it may be the best approach is to wait-and-see. A surcharge of 5 has been proposed for adjusted gross income AGI in excess of 10 million 200000 for trusts estates and an additional tax of 3 of AGI in excess of 25 million 500000 for trusts estates. The introduction of a 3 additional tax on high income individuals 5 million if married filing jointly and trusts and estates with income above 100000.

Current proposals seek to reduce the exemption equivalent for the gift tax exemption amount to 1000000 and the estate tax and generation-skipping transfer tax exemption amount to 3500000. Transfer tax regime by increasing estate gift and generation-skipping transfer GST taxes and vitiating the effectiveness of certain wealth transfer planning. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million.

An additional surtax of 3 on MAGI of non-grantor trusts over. Capital gains taxes impact manufacturing housing and farming among others. Moreover proposals recommend raising the current maximum transfer tax rate of 40 to 45-65.

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Regardless of the exemption levels considered few estates are affected by the tax. Impose a minimum 15 corporate income tax on the book earnings of large corporations.

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Two of the most significant proposed changes include. As of this writing Democrats in Congress are negotiating the so-called Build Back Better bill.

The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1 2022 instead of. The top marginal income tax rate would rise from 37 to 396. How do I protect my assets from estate tax.

The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. Imposition of capital gains tax on appreciated assets transferred during life or at death. The increase in the exemption level costs around 10 billion per year a further reduction of about 40 of projected revenues.

It remains at 40. 2021-2022 town of brookhaven 2021-2022 louis j. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

The proposal would increase the top marginal individual income tax rate to 396. There will be no clawback for use of the increased exclusion amount meaning that a person will not be penalized for gifting 11000000 of assets if she passes away in a year when the applicable exclusion amount is 6000000. Furthermore the timing of tax burden could change significantly depending upon the implementation of the carry-over basis.

The proposed effective date for the estate and gift tax changes would be for death and. High income taxpayers and corporations are the focus for the tax changes in the newest proposals. This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately 6000000.

Current 117 million gift and estate tax exemption could be reduced to approximately 603 million after December 31 2021. Change in Tax Rates There could be an additional 3 tax on individuals trusts and estates with high earnings. Eliminate incentives for fossil fuels and addincrease incentives for alternative energy.

Any modification to the federal estate tax rate. Two-thirds reduction in estate tax revenues. It would be hasty to make any estate changes based on current discussions.

Increase the corporate income tax rate from 21 to 28. Income Tax Calculator. Estate and gift tax exemption.

Decrease of Estate and Gift Tax Exemption. The increase of the top marginal income tax rate from 37 to 396. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for.

For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. According to Shearman Sterling LLP o n March 25 2021 Senators Bernie Sanders VT and Sheldon Whitehouse RI introduced the For the 995 Act the Act which proposes major changes to the US. If passed the proposed increase on the rate of estate tax would move to 45 for estates valued between 35 million and 10 million 50 for estates over 10 million but less than 50 million 55 for estates between 50 million and.

An elimination in the step-up in. The Bill includes several other changes that if enacted could affect existing estate plans. Estate is 16000000 Exemption 1000000.

Consumer Spending Forecast 2021 Deloitte Insights

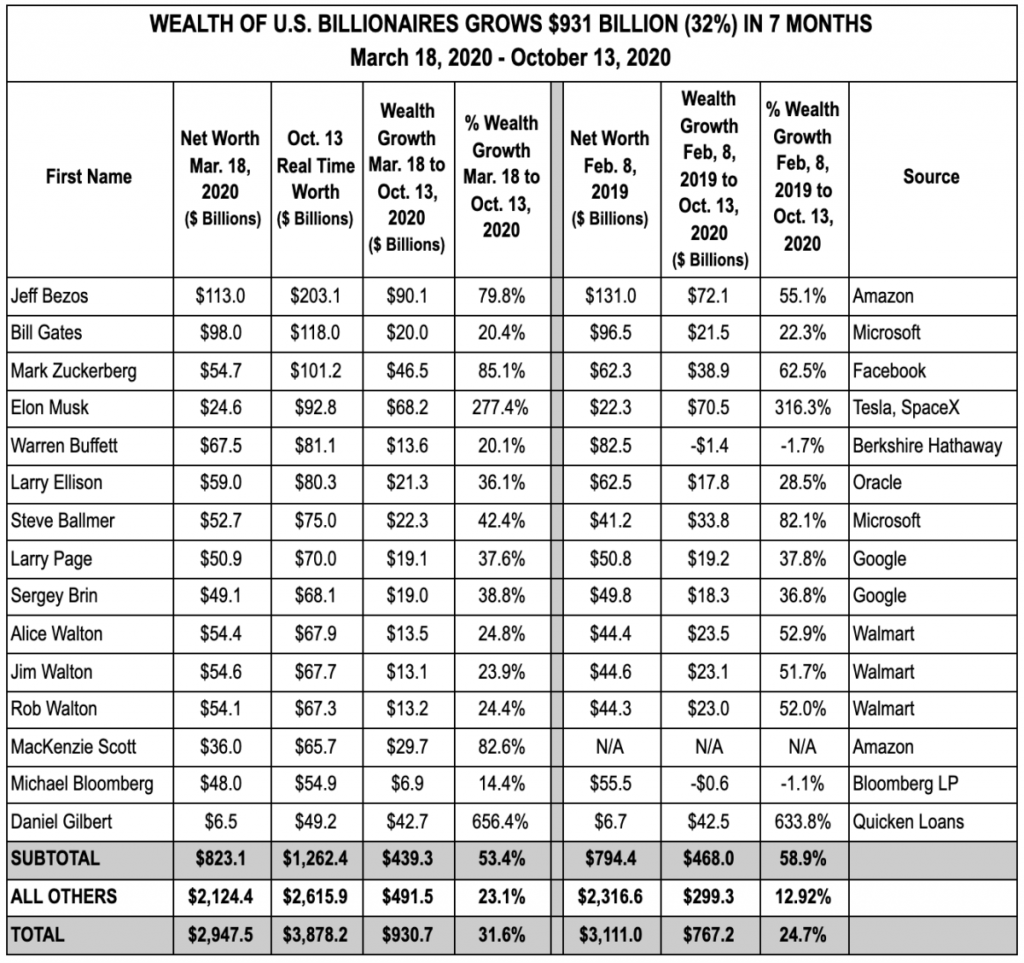

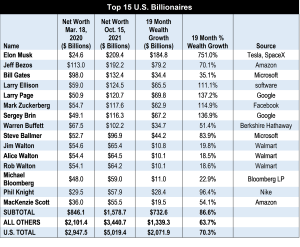

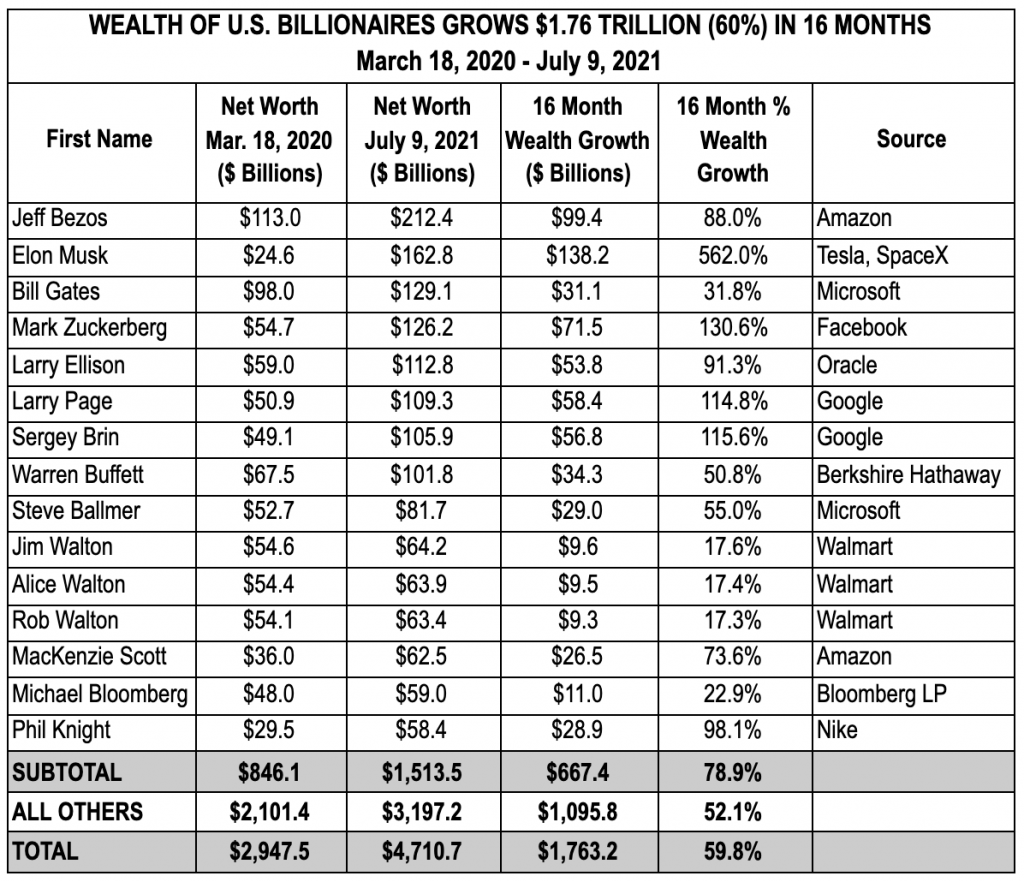

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

Spanish Style Windows Give Your Windows A Spanish Flair Spanish Style Homes Spanish Style Spanish Colonial Exterior

Managing Your Personal Taxes 2021 22 A Canadian Perspective Ey Canada

Us Interest Rates Farmdoc Daily

Covid 19 Vaccination Policy For Bc Public Service Employees Province Of British Columbia

Consumer Spending Forecast 2021 Deloitte Insights

Coinflex Announces Its Major Milestones Of 2021 Milestones Cryptocurrency News Market Liquidity

Outside Lands Announces 2021 Lineup Feat The Strokes Tyler The Creator Lizzo Tame Impala Pursuit Of Dopeness Tame Impala The Strokes Outside Lands

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

/dotdash-7-of-the-highest-stock-prices-in-history-brk-b-aapl-seb-nvr1114-FINAL-74561db190a74d4aa1197891d2328783.jpg)

10 Of The Highest Stock Prices In History

:max_bytes(150000):strip_icc()/dotdash-7-of-the-highest-stock-prices-in-history-brk-b-aapl-seb-nvr1114-FINAL-74561db190a74d4aa1197891d2328783.jpg)

10 Of The Highest Stock Prices In History

Digital Land Grab Metaverse Real Estate Prices Rose 700 In 2021

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

Quits Big Raises And Severe Labor Shortages The U S Jobs Market In 2021 The Washington Post